Guest contribution by Ricardo Paes Mamede (Assistant professor at the Department of Political Economy of ISCTE – University Institute of Lisbon)

A long book is probably too short to explain the European crisis in full length and depth. However, the essential causes of this crisis can be grasped with two simple ideas.

1) The sovereign debt crisis stems from the accumulation of external debt (both public and private) in some EU economies since the early 1990s

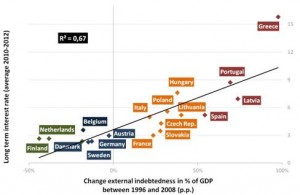

Since 2010, the interest rates on the sovereign bonds of some EU countries has increased sharply. According to the official view, the causes of this sovereign debt crisis are to be found in unsustainable national fiscal policies and the postponement of ‘structural reforms’– mainly labour market liberalisation and pension systems’ reforms – in the countries most affected by the crisis. But this is not what the data show. Fiscal developments and changes in labour market laws and pension systems vary widely across countries, both among those most affected by the crisis and among the remaining EU member states. On the contrary, as the first graph shows, the relation between the sovereign debt crisis and external indebtedness (public and private) is rather clear: countries whose sovereign debt interest grew the most in 2010-2012 were those which accumulated more external debt since the mid-1990s (Figure 1).

Figure 1 – Correlation between the accumulation of external debt (% of GDP) and sovereign debt crisis

Source: AMECO

Notes: External indebtedness is measured by the International Investment Position, a commonly used indicator of external debt. Data on some EU countries is unavailable for the period under analysis, namely: Bulgaria, Cyprus, Estonia, Slovenia, Ireland, Malta and Romania.

Therefore, in order to understand the causes of the European crisis first we have to explain why some countries accumulated more external debt (public and private) than others over the years. This brings us to the second idea.

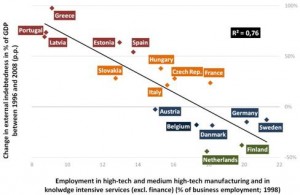

2) The determining factor behind the growing indebtedness of some countries (and improved external position of others) is the specialization profile of each national economy

In the 20 years preceding the global crisis of 2008/9, EU economies have undergone significant transformations, most of which were politically induced. These include: the abolition of customs barriers within the EU, the creation of the internal capital market, the liberalization of financial flows and activities, the increasing EU level control over monetary and fiscal policies, the trade agreements between the EU and China (and other emerging economies), the Eastern EU enlargement, the appreciation of the euro against the dollar (from 2003), or the sharp increase in oil prices (between 2002 and 2008). These changes encompassed all Member States, but had very different impacts across countries. Lacking the appropriate policy instruments to manage such impacts, countries with less advanced productive structures accumulated more debt (public and private) than the others. This is shown in Figure 2.

Figure 2 – Relationship between the accumulation of external debt and the specialization profile of each national economy

Sources: Eurostat and AMECO

In other words, the rules and institutions of the EU have proved very suitable for certain economies with more advanced productive structures, but detrimental for others. It is worth noting that productive structures take a long time to change, regardless of the policies pursued at the national level.

Conclusion

It makes little sense to sustain that the sovereign debt crisis is fundamentally caused by government misconduct in specific countries. To be sure, citizens from different parts of Europe have many reasons to complaint about the quality of their democracies and the about decisions taken both at the national and the EU levels. Still, the main mistake of the national leaders of those countries most affected by the crisis was probably the decision to participate in the European integration process according to the rules that were adopted in the past decades, without anticipating the difficulties this would create for their economies. Their greatest mistake will be to persist in the same path.