The euro is many things at once. Like all other currencies, it is a means of payment, a unit of account and a store of value. Since its inception, it is an attempt to challenge the hegemony of the US dollar as world currency. Insofar as it embodies the transfer of monetary and exchange rate policy from the national to the European level, it is a major step in the process of European integration – albeit one increasingly regarded as ill-advised and out of sequence. But it is also, and somewhat more prosaically, an especially fixed fixed-exchange-rate system – and in that sense, it is also an exercise in historical hubris.

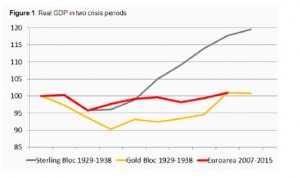

During the course of the 20th century, there have been three major attempts at setting up fixed exchange rate regimes involving significant portions of the advanced capitalist world. The first one was the gold standard of the late 19th and early 20th centuries, which fell apart as a consequence of the outbreak of World War I (as the warring parties felt compelled to adopt expansionary policies in order to finance the cost of war), was resurrected in the mid-1920s, and finally collapsed again as it confronted the structural crisis of the late 1920s and 1930s (otherwise known as the Great Depression). This final undoing of the gold standard was a protracted affair: while Britain and the countries of the so-called ‘sterling bloc’ left as early as 1931, others lingered on until 1938. In historical hindsight, we now know that those countries that abandoned the fixed-exchange-rate regime earlier did a much better job at overcoming the Great Depression (see Figure below, taken from here). Little wonder, then, that the experiment was doomed to fail sooner or later.

The second major experiment in fixed-exchange rates was the one adopted in the context of the post-1944 Bretton Woods system, in the context of which currencies were pegged to the US dollar, which in its turn was convertible into gold at a fixed rate of US$35 per ounce. It remained in place until the Nixon shock of 1971, whereby the suspension of the convertibility of the US dollar did away with the Bretton Woods fixed-exchange rate system and replaced it with a freely floating currency regime. The proximate cause of its downfall was the US government’s need to finance the Vietnam War, but the deeper underlying cause was the structural crisis of the 1970s (which in fact began to make itself manifest in the late 1960s) and its constraining effect upon profitability, output and fiscal revenue.

And so we get to the third major experiment in fixed exchange rates of the 20th century: the euro, with its predecessor the EMS. The predecessor itself came undone as it confronted the minor crisis of the early 1990s, but still the experiment was carried forward, in a sense through raising the stakes and pressing ahead, in the form of the euro. Then followed the structural crisis of the late 2000s and 2010s – and the rest, well, the rest is history being made as we speak.

Each major fixed-exchange-rate regime experiment of the past 150 years has been undone by each of the structural crises which swept advanced capitalism. Expecting the euro to resist the current structural crisis, at a time when that crisis has scarcely begun to be overcome, while reacting through ever-more-deflationary policies that only exacerbate that crisis, is what I call a fair amount of hubris. A Greek tragedy, as it were.